Vendors, Team & Employees: The Difference Between Employees vs. Contractors

You’re building your team. But should your next hire be an employee or a contractor? While this often falls under the Human Resources umbrella, we are asked this question by the business owners we support because of the financial implications of hiring (taxes, payroll, cash flow).

As a business owner, it’s not up to you to decide how to classify your employees. The law dictates this. There are fines and there can be serious legal and financial consequences (you could be liable for back taxes) for incorrectly categorizing a worker, so you really don’t want to wing it here.

As always, we recommend getting advice on your specific business and needs from a human resources or employment specialist AND your accounting team when making any hiring decisions.

According to the IRS, here is the official difference between the two:

👉 An employee is “anyone who performs services for you… if you can control what will be done and how it will be done. This is so even when you give the employee freedom of action.”

👉 An independent contractor is someone whom “the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.”

Here are 3 questions to ask yourself when considering your next hire:

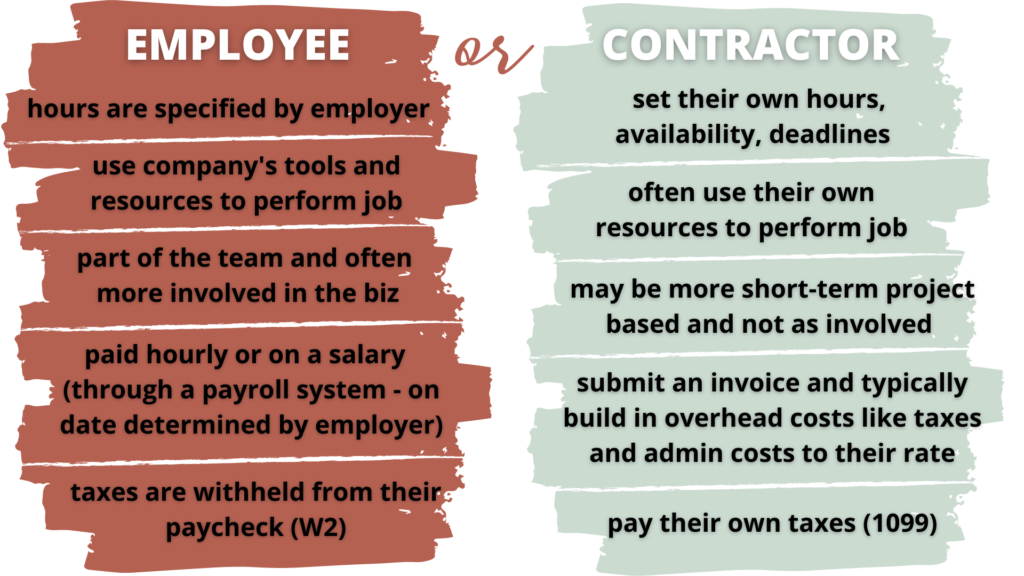

- Who is controlling their work hours and deadlines? Employees work hours specified by their employer. They typically use the company’s tools and resources to perform their job. Contractors set their own availability, communicate when they will work and when projects will be completed, and often use their own tools to perform their job.

- How and When Will they be paid? Independent Contractors typically submit an invoice and they are responsible for paying (and are typically building in) overhead costs like taxes and admin fees to their rate. Employees are paid hourly or on a salary and typically through a payroll system. Taxes are withheld from their paycheck and the pay date is determined by the employer.

- What does the relationship with them look like? Think about if you are hiring this person for a specific (more short-term) project or if you want them to be taking on a role as part of your team more long-term. Will they provide services to other businesses?

Depending on the details of these answers, you’ll be able to determine if your next hire should be an independent contractor or employee.

Here’s a chart to help you differentiate the two:

Now, I can already tell what you are thinking. But don’t let the idea of an “employee” scare you. Yes, there is a little more paperwork involved (Empowered Profit can help with that). When you break it down, hiring an employee is often not more expensive. Yes, there are requirements for having an employee, but you aren’t required to offer a retirement account, health insurance, or paid time off. And, if you do want to offer those things – we can help you with that too!

The biggest determining factor we find is that if you want this person available to you regularly and want to control deadlines and timeframes of work getting done, they should actually be an employee.

Before you go….one more tip…

Please do NOT start someone as a contractor first to “test it out” before moving them over to an employee. You’ve decided you are ready to hire someone, so do the research (or ask your accounting team) and make the commitment. The penalties, fines, and implications of misclassifying an employee are not worth it.

If you need more help with hiring paperwork or support with the financial implications of hiring (taxes, payroll, cash flow) – we can help!

This is provided as information only and as a starting point for a conversation with your own legal and accounting team, this should not be considered legal or financial advice.

All of these decisions are based on a number of factors and we cannot guarantee that you will experience any specific results based on any information provided. Please speak with your own retained professionals to ensure that you are making the best decisions for your business & personal situation.

Please speak with your own retained professionals to ensure that you are making the best decisions for your business & personal situation.