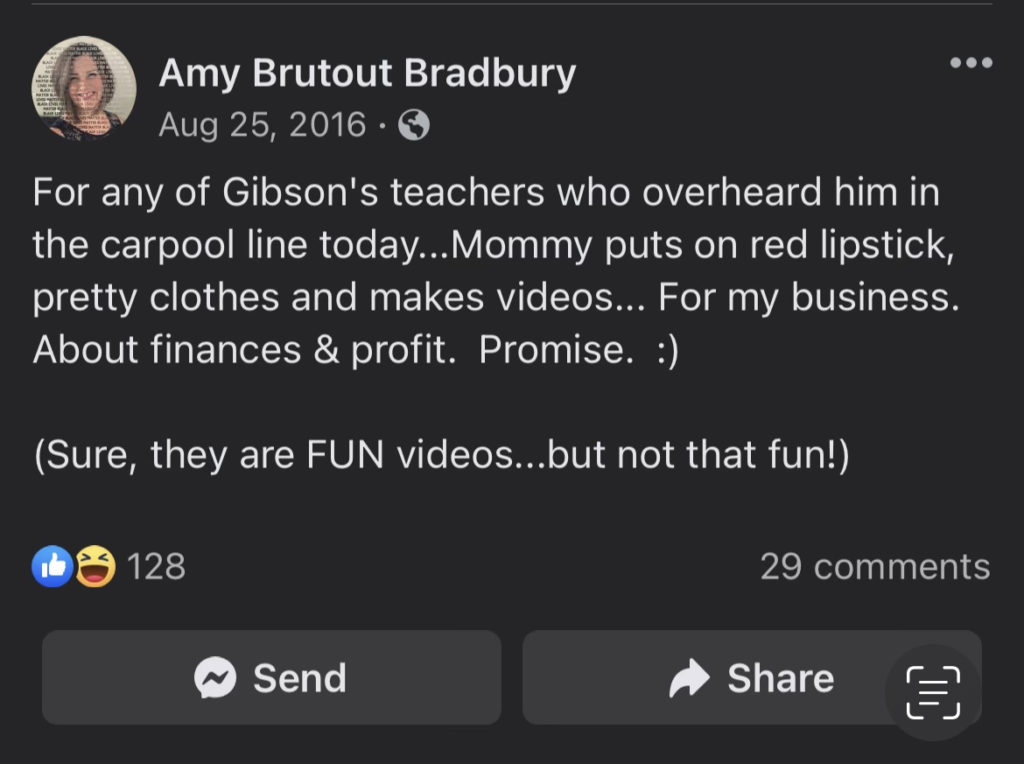

I had a little explaining to do in the carpool line when my then 6 year old blurted that out during school drop-off one day. Many of the other parents and teachers were confused, and honestly the IRS doesn’t understand what I do in my business much better.

If you spend hours teaching workshops on zoom, have live events or have live speaking engagements, it seems like the clothing, hair and make-up expenses would be tax-deductible, right? I mean, the computer, camera and software we use is – so that’s totally reasonable to think that. Well, as we have learned, the’ tax code & reasonable’ don’t exactly belong in the same sentence. 😆

We get this a lot from our clients, but here’s the nitty gritty…

The IRS is pretty strict when it comes to what they consider to be “ordinary and necessary” in terms of business expenses. And a lot of their definitions don’t cover businesses like yours who are doing this kind of work. I mean let’s be serious, they have barely updated their knowledge to understand online businesses!

So, our gut feeling would be that if you asked them directly (imagine a bunch of old dudes with pocket protectors sitting around a wooden conference table) they would not agree that your makeup and clothing for a photoshoot would be ordinary and necessary. Simply because they wouldn’t understand your business and the need for them.

However, your tax preparer or accountant is not required to ‘audit’ or prove the expenses that you are taking as business deductions. It is up to you to honestly and accurately provide this information to them. So it really comes down to your own decision on how aggressive you want to be with what you want to consider a business write-off.

Cynthia Hess, a dancer in Indiana underwent breast augmentation surgery and tried to get a depreciation tax break on the implants, declaring them a deductible business expense. And in 1994, the U.S. Tax Court actually made an exception and ruled in Cynthia Hess’ favor. Read more on this case here.

My guess is that the IRS is a little stricter these days, but still proof that if you are willing to go the lengths to prove it, it might be worth it!

If you report a category to us of “marketing” we aren’t required to dive deeper into everything that’s included in there. And, it’s also your responsibility to be able to prove the expenses to the IRS should there ever be a review or audit of your return by them. So it’s a risk you may take in writing those off if you later have to repay the taxes if there’s an adjustment.

Now, there’s a pretty low probability of being audited, but it could happen. So, ultimately, it’s your decision on how aggressive you want to be with what you want to write off through the company.

This is why it’s super important to work with a financial team (like Empowered Profit) who knows your business and you’ve developed trust with, so they can help you come to an informed decision. Want more info on working with us? 👇

But we do want you to be as informed as possible, so we would like to add that the IRS has pretty strict rules on clothing. Again, this doesn’t relate specifically to your business, but there are quite a few IRS Court Cases that revolve around clothing that we use as a guide.

Generally, the cost of a business wardrobe, even if required as a condition of employment, is considered a nondeductible personal expense. Those costs are not deductible even when it has been shown that the particular clothes would not have been purchased but for employment.

Clothing is only deductible if it could never be worn anywhere else. Now, while we understand that a specific suit or dress is something you only use for events, it could still be worn outside of business purposes and therefore is not deductible.

But there have been some cases where the US Tax Court ruled in a person’s favor on this. For example, in Raul Romana et. al. v. Commissioner – scrubs were purchased and deemed that they were not usable outside of that specific employment. Also, a lab jacket that was embroidered with the hospital name could not be worn anywhere but that location, so they were deductible. Read more on this case here.

The rules on makeup are not as documented, and what is available is geared towards performers, but it is fairly standard to treat it the same as clothing – if it can be worn somewhere other than the business event, it is not deductible. We recommend renting clothing from a service like Rent the Runway, and paying for a makeup artist who uses their own products when planning for a photoshoot or an event.

TLDR:

All in all, clothing, make-up and hair is all going to be pretty hard to prove as a business expense, even if you did only do it for the event, workshop or occasion. All deductions must be “ordinary and necessary” in terms of business expenses – according to tax law, not your definition of them.

Your tax preparer or accountant is not required to ‘audit’ or prove the expenses that you are taking as business deductions. It is up to you to honestly and accurately provide this information to them. So it really comes down to your own decision on how aggressive you want to be with what you want to consider a business write-off.

This is provided as information only and as a starting point for a conversation with your own legal and accounting team, this should not be considered legal or financial advice.

All of these decisions are based on a number of factors and we cannot guarantee that you will experience any specific results based on any information provided. Please speak with your own retained professionals to ensure that you are making the best decisions for your business & personal situation.

Please speak with your own retained professionals to ensure that you are making the best decisions for your business & personal situation.